The “Limitation on Benefits” (LOB) article is an anti-treaty shopping provision intended to prevent residents of third countries from obtaining benefits under a treaty that were not intended for them. Line 14b: You must check the box immediately after "b." if you are claiming any treaty benefits. If your resident country has entered into an income tax treaty with the U.S. that contains a "Limitation on Benefits" (LOB) article, you must check one of the checkboxes in line 14b. For those few treaties in which there is no LOB provision, "No LOB article in treaty" box must be checked. For treaty purposes, a person is a resident of a treaty country if the person is a resident of that country under the terms of the treaty. Line 14a: Write in the country for which treaty benefits are being claimed on Line 14a. IRS Tax Treaty Tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. W8 IMY INSTRUCTIONS FULL

You can obtain the full text of tax treaties and accompanying Technical Explanations and Protocols at United States Income Tax Treaties - A to Z. Part III must be correctly completed if you are claiming a reduced rate of, or exemption from, withholding under an income tax treaty.

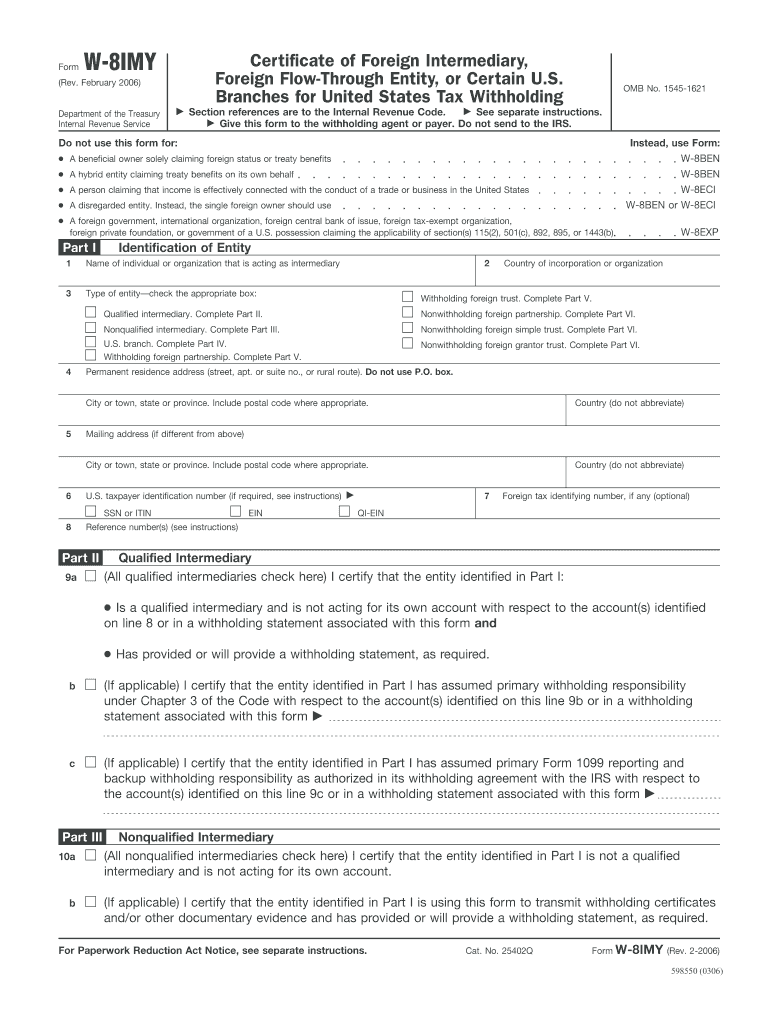

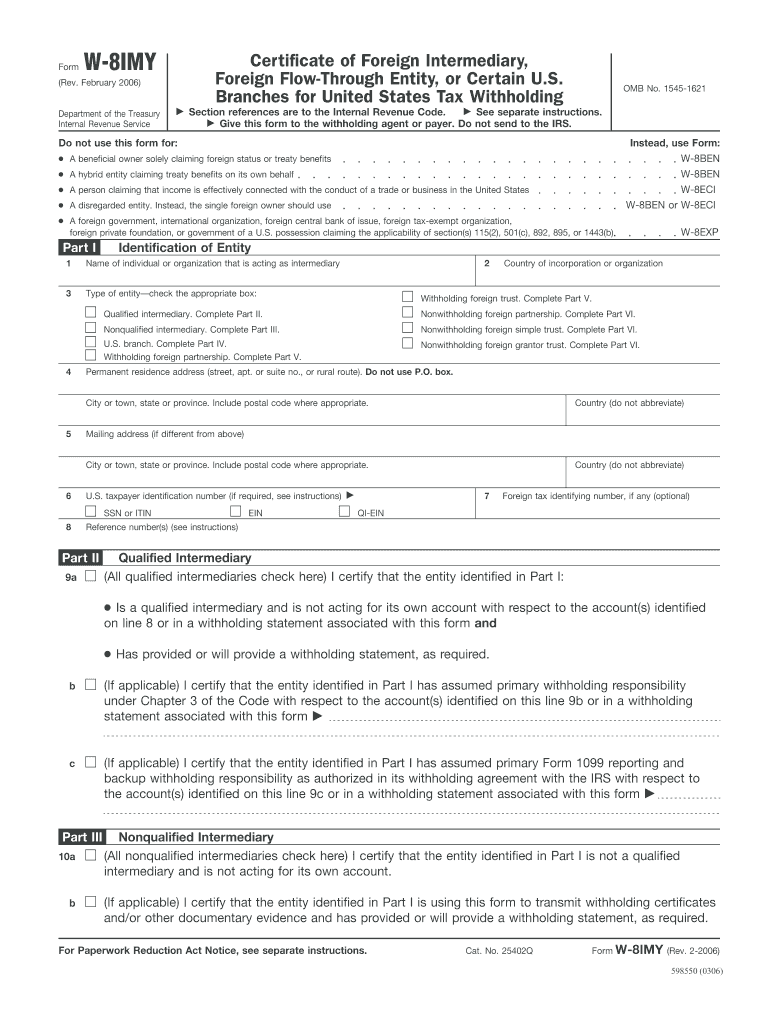

Line 9b: Enter your foreign tax identification number. Line 8: If you have a U.S taxpayer identification number (ITIN), enter it here. Line 7: Enter your mailing address only if it is different from the address you show on line 6. Line 6: Your permanent residence address is the address in the country where you claim to be a resident for purposes of that country’s income tax.  Line 4: Check the appropriate box for Chapter 3 Status (entity type). Line 3: Complete this line if applicable. Line 2: Enter country of incorporation or organization. Part I Identification of Beneficial Owner Instructions for Form W-7-A, Application for Taxpayer Identification Number for Pending U.S.The W-8BEN-E is used to confirm that a supplier is a foreign entity and must be provided even if the supplier is not claiming a reduced rate of, or exemption from, withholding as a resident of a foreign country with which the United States has an income tax treaty and who is eligible for treaty benefits. Generally, a Form W-8BEN-E is valid for a three calendar-year period.įor Chapter 3 payments, the following lines must be correctly completed for UMass to accept the Form W-8BEN-E: Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY Instructions for Form W-8BEN, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Instructions for Form W-8BEN-E, Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Instructions for Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

Line 4: Check the appropriate box for Chapter 3 Status (entity type). Line 3: Complete this line if applicable. Line 2: Enter country of incorporation or organization. Part I Identification of Beneficial Owner Instructions for Form W-7-A, Application for Taxpayer Identification Number for Pending U.S.The W-8BEN-E is used to confirm that a supplier is a foreign entity and must be provided even if the supplier is not claiming a reduced rate of, or exemption from, withholding as a resident of a foreign country with which the United States has an income tax treaty and who is eligible for treaty benefits. Generally, a Form W-8BEN-E is valid for a three calendar-year period.įor Chapter 3 payments, the following lines must be correctly completed for UMass to accept the Form W-8BEN-E: Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY Instructions for Form W-8BEN, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Instructions for Form W-8BEN-E, Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Instructions for Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

Instructions for Form W-8EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting Branches for United States Tax Withholding and Reporting Instructions for Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Instructions for the Requestor of Form W-9, Request for Taxpayer Identification Number and Certification

0 kommentar(er)

0 kommentar(er)